NBA teams are clearly ego purchases, but rich guys hate losing money … and that’s about ego, too. In 2010 and 2011, six NBA franchises sold or changed hands, and another four were practically thrown on Craigslist.2 That’s one-third of the league. A steady stream of billionaires crunched numbers and came to the same conclusion: Unless it’s a killer market, the NBA isn’t a good investment. During 2011’s lockout, Philly sold for a measly $280 million as the league frantically looked for a New Orleans buyer (and didn’t find one).

Everything flipped in December of that year, after the NBA negotiated an owner-favorable collective bargaining agreement (and then some) that included a 50-50 revenue split, shorter long-term deals and a more punitive luxury tax system, as well as a pay-per-view event in which David Stern and Adam Silver poured Dom Perignon on each other’s heads and danced over the ruins of Billy Hunter’s career. Fine, I made that last one up. From there, everything kept breaking the NBA’s way. In no particular order …

• The economy rebounded (at least in rich guy circles).

• The economy rebounded (at least in rich guy circles).

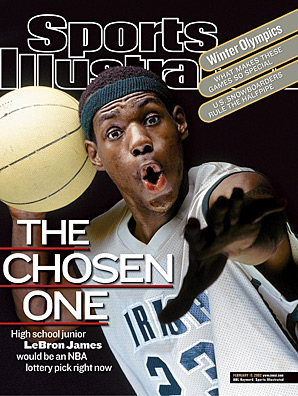

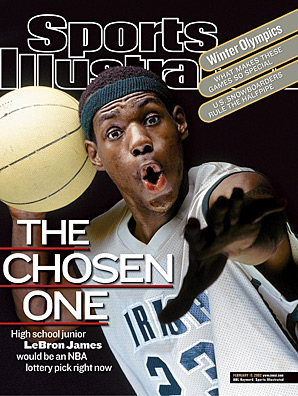

• LeBron became the league’s most famous and talented superstar since MJ, right as we suddenly had the deepest pool of under-27 stars in 20-plus years.

• The 2013 Finals went down as one of the greatest Finals ever, followed by a LeBron-Durant rivalry emerging that could and should carry the rest of the decade.

• Americans stopped caring about PEDs and started worrying about concussions right when everyone should have started worrying about PEDs in basketball (a sport that rarely has any concussions).

• The YouTube/broadband/iPad/GIF/Instagram/Twitter era turned basketball into a 24/7 fan experience — just the ideal sport for the Internet era, the kind of league in which your buddies email you a bizarre Kobe Bryant tweet, an endearing Spurs team selfie and a ridiculous Blake Griffin dunk GIF in the span of three hours (and by the way, that happened to me yesterday).

• A new multimedia rights deal is coming soon … and it’s going to easily double the current deal.

(Repeat: easily double it.)

And I didn’t even mention basketball grabbing the no. 2 spot behind soccer as the world’s most popular sport. I’m not sure when it happened, but it happened. Buy an NBA franchise in 2014 and deep down, you’re thinking about stuff like, I wonder if fans from 250 countries will be paying for League Pass 20 years from now? Throw in the other breaks and that’s how you end up climbing from here …

via The World’s Most Exclusive Club «.

Like this:

Like Loading...